Social Security benefits are an important part of many American workers’ retirement plans. The purpose of this post is to provide readers with a quick sense for how retirement benefit amounts are determined and eligibility requirements.

WHO IS ELIGIBLE TO RECEIVE SOCIAL SECURITY RETIREMENT BENEFITS?

To qualify for benefits, applicants must be at least 62 years old and meet certain lifetime earnings requirements. Because the earnings bar is so low, most healthy people with at least 10 years of work experience will be included in the program. The Social Security Administration estimates that approximately 90 percent of Americans over the age of 65 currently collect Social Security retirement benefits.

Workers earn credits toward eligibility based on their lifetime earnings. They will need to accumulate at least 40 credits over their working life to be benefit eligible. In 2017, Social Security will award one credit for every $1,300 in earnings, up to a maximum of 4 credits a year. If someone earns just $5,200 this year ($1,300 x 4 = $5,200), they will pick up 4 credits. Because benefit recipients need to accumulate 40 credits over their lifetime, they must work some amount of time in at least 10 years to pick up the required total.

HOW ARE MONTHLY PAYMENTS DETERMINED?

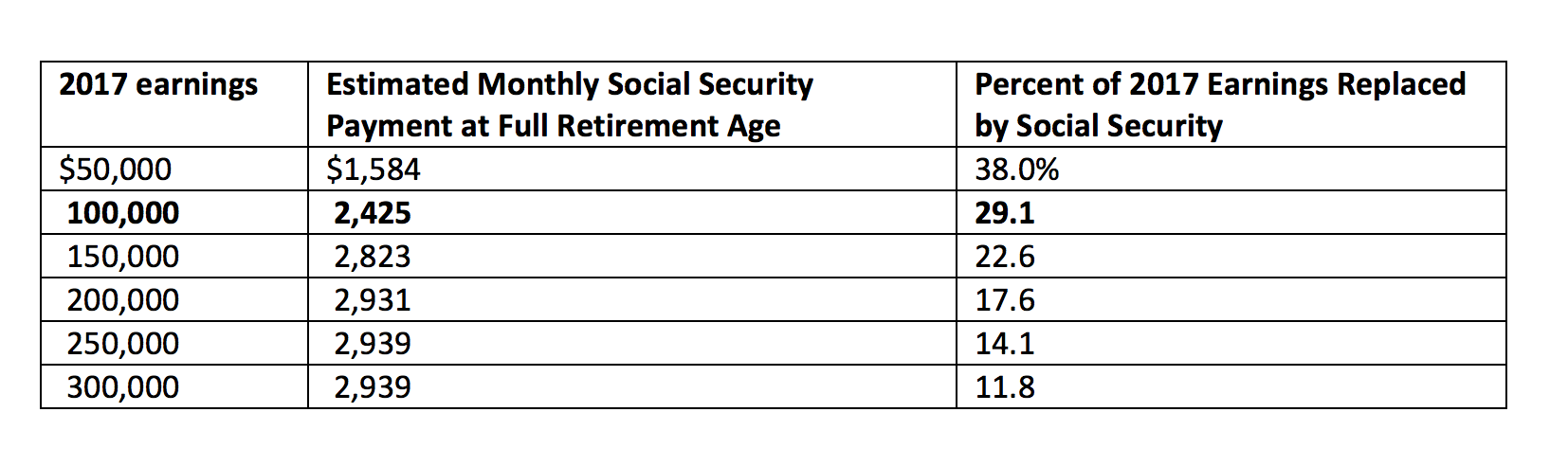

The benefit payment is based on how much the person earned during their working life and the age at which they elect to draw benefits. Higher lifetime earnings result in higher benefits, but this impact tapers off at higher earning levels. The benefit formula is weighted toward lower-income workers and tends to replace less pre-retirement income of higher earners. Delaying retirement can also increase monthly payments, within certain limits. Let’s look at each of these factors to see how changes in them can impact the monthly payment.

For purposes of illustration, consider “Jane Doe”, born on April 1, 1960 (so she is now 57 years old) who will make $100,000 this year. The Social Security Administration provides a quick calculator that can be used to estimate her benefits. The calculator makes certain assumptions about Jane’s historical earning profile based on earnings today.

(click here to go to the calculator https://www.ssa.gov/OACT/quickcalc/index.html)

Using this calculator, Jane would likely receive $2,425 of monthly Social Security benefits, or $29,100 annually, when she retires in 10 years in 2027. Relative to her $100,000 of earnings, Social Security will replace 29.1 percent of it ($29,100 / $100,000 = 29.1%). Because many financial advisors recommend clients have savings and retirement benefits to replace at least 70 to 80 percent of annual earnings, Social Security is an important, but incomplete answer, to funding a retirement.

As Jane’s lifetime earnings increase, so do her Social Security benefits. As shown in the table below, if Jane earns $200,000 in 2017 rather than $100,000, then the Social Security quick calculator indicates she would likely receive a monthly payment of $2,931, which is $506 a month higher than the base case. But starting around $250,000 in annual income, benefits no longer increase with higher earnings.

“JANE DOE” AT FULL RETIREMENT AGE

In addition to earnings, Jane’s Social Security payment will also vary significantly depending on when she elects to start drawing benefits. Every eligible beneficiary has what is called a “Full Retirement Age” specified by Federal legislation. For people born in 1960 or thereafter, the Full Retirement Age is 67 years old. For those born earlier, it is somewhat younger. In the case of Jane, her Full Retirement Age is 67.

If Jane elects to delay retiring until she is 70 years old, then her monthly Social Security check will increase by 26 percent. If she elects to retire earlier at 62, the youngest age permitted, then her monthly payment would decline 32 percent relative to the full retirement payment.

ARE THERE ADDITIONAL SOCIAL SECURITY BENEFIT PROGRAMS?

Yes, there are four additional benefit programs:

1. Spousal benefits: If both parties file for Social Security at full retirement age, then each spouse is entitled to half of the other's benefit. For example, if Jane Doe is married, then her spouse will generally receive at least $1,212 (using the base case above), even if their own benefit amount is less.

2. Survivors' benefits: If a worker dies, their widow, children, and other dependents may be eligible for benefits.

3. Disability benefits: If someone becomes disabled and can no longer work, they may be eligible for Social Security Disability benefits.

4. SSI benefits: Supplemental Security Income, or SSI, provides extra income to disabled or retired individuals with limited assets and income.

DISCLAIMER: This information is not intended to provide legal or accounting advice, or to address specific situations. Please consult with your legal or tax advisor to supplement and verify what you learn here. This is presented for informational or educational purposes only and does not constitute a recommendation to buy/sell any security investment or other product, nor is this an offer or a solicitation of an offer to buy/sell any security investment or other product. Any opinion or estimate constitutes that of the writer only, and is subject to change without notice. The above may contain information obtained from sources believed to be reliable. No guarantees are made about the accuracy or completeness of information provided. Past performance is no guarantee of future results.